Bitcoin halving is one of the most talked-about events within the world of cryptocurrency. Every four years, this event takes place, slashing the block reward for miners in half and decreasing the number of new bitcoins coming into circulation. But why does this matter? Bitcoin halving has the potential to affect the price, the supply, and even the overall adoption of the cryptocurrency, making it a pivotal moment for both traders and enthusiasts.

Bitcoin halving is often surrounded by a combination of anticipation, speculation, and excitement. For long-time followers of the crypto space, it’s an event that signals both opportunity and uncertainty. The reduction in the reward is designed to control inflation and ensure that Bitcoin’s total supply remains limited to 21 million coins. Understanding Bitcoin halving, its effects, and its potential implications is key to making informed decisions in the volatile world of cryptocurrencies.

What is Bitcoin Halving? A Simple Explanation

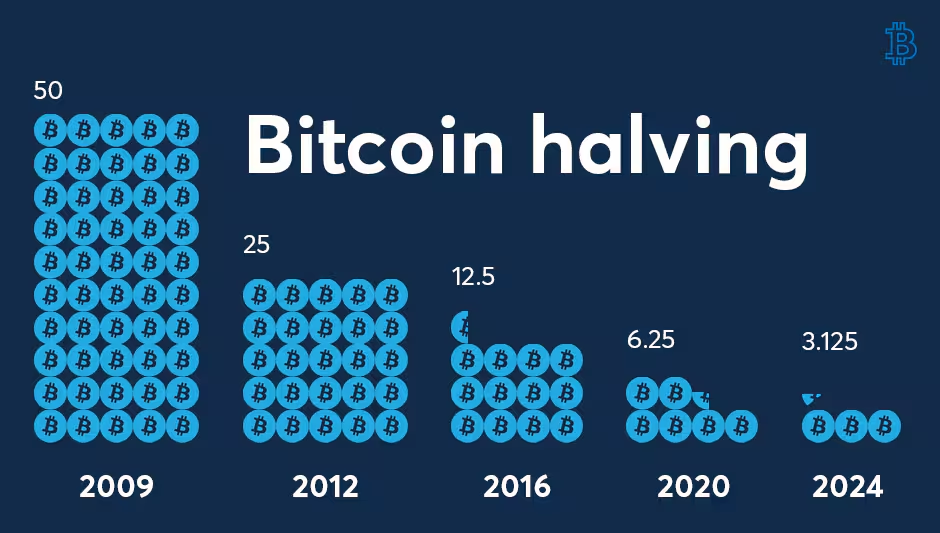

Bitcoin halving refers to the process where the reward that miners receive for validating transactions is cut in half. This happens approximately every four years or every 210,000 blocks, which is a mechanism built into the Bitcoin protocol to control its inflation rate and slow the introduction of new bitcoins. Initially, when Bitcoin was launched in 2009, miners received 50 bitcoins per block. After the first halving in 2012, this reward dropped to 25, and it has continued to lower with each halving event.

This scarcity mechanism is one of the core features of Bitcoin, making it an attractive alternative to traditional fiat currencies, which can be printed without limit. Halvings are important because they reduce the rate at which new bitcoins are introduced into the market, which, in theory, can increase demand, especially as Bitcoin’s overall supply nears its cap of 21 million coins.

How Bitcoin Halving Affects Miners and the Market

Miners play a crucial role in the Bitcoin network. They are responsible for verifying transactions and securing the blockchain. In return for their efforts, miners receive Bitcoin as a reward. However, the Bitcoin halving event reduces the reward that miners receive for their work. This reduction means miners must operate more efficiently to remain profitable.

The drop in mining rewards could lead to some miners exiting the market, especially those with less efficient hardware or higher operational costs. However, miners with access to cheaper energy and more advanced mining equipment are likely to stay in the game, ensuring the network remains stable.

Impact on the Bitcoin Price

Historically, Bitcoin halving has been associated with significant price increases. While there is no guaranteed correlation, the supply reduction often leads to increased demand. As fewer bitcoins are introduced into circulation, the scarcity effect kicks in, which could push the price higher. The most notable price surge came after the 2016 halving, when Bitcoin’s price skyrocketed from around $600 to almost $20,000 by the end of 2017.

The market’s reaction to halving events is often filled with speculation. Some traders believe that halving will lead to a price increase, while others are skeptical, viewing the event as an opportunity for short-term profits. Nonetheless, Bitcoin halvings continue to attract significant attention from both institutional investors and individual traders.

Bitcoin Halving and Its Long-Term Implications

The reduction in the block reward has profound implications for the basic economic principles of supply and demand. With a capped supply of 21 million bitcoins and a predictable halving schedule, Bitcoin presents a deflationary model that contrasts sharply with the inflationary nature of traditional fiat currencies.

As Bitcoin approaches its maximum supply, the amount of new bitcoins entering circulation will decrease further, which could have a significant impact on its value. If demand continues to grow while supply slows, Bitcoin’s price may continue to rise. However, this also depends on other factors, including global economic conditions, regulatory environments, and the adoption of Bitcoin as a store of value or medium of exchange.

The Role of Institutional Investors

Bitcoin’s increasing appeal to institutional investors has been another important aspect of its halving events. As Bitcoin becomes more recognized as a potential hedge against inflation and a form of digital gold, more institutional players are entering the market. These investors may view halvings as a signal of Bitcoin’s growing scarcity, which could drive further adoption.

Several prominent investors, including hedge fund managers and Bitcoin advocates like MicroStrategy’s Michael Saylor, have emphasized the importance of Bitcoin’s supply restrictions. Saylor recently stated in an interview,

“Bitcoin’s scarcity is its most valuable asset. We’ve seen how scarcity increases the value of commodities like gold, and Bitcoin will follow the same path.”

The Future of Bitcoin Halving

Bitcoin’s halving schedule will continue until the year 2140, at which point no new bitcoins will be created. At that time, miners will rely solely on transaction fees for their income. This model ensures that Bitcoin remains scarce, and the network’s security is maintained through incentives for miners. The long-term implications of Bitcoin’s halving events remain to be seen, but many believe that this scarcity model could establish Bitcoin as a dominant player in the global financial system.

What Reddit Thinks About Bitcoin Halving

Bitcoin halving has long been a subject of intense discussion on forums like Reddit, where users share their predictions, experiences, and theories about the future of Bitcoin. In a post on the r/Bitcoin subreddit, one user commented, “Every halving brings more awareness to Bitcoin. As the supply shrinks, more people are going to realize just how valuable this asset is. The price will inevitably reflect that.”

However, not all Reddit users are convinced that halving events will continue to drive Bitcoin’s price upwards. Some members of the community are cautious, pointing out that market conditions, such as regulatory changes or technological advancements in mining, could affect the outcomes of future halvings. As one Redditor put it, “The price may not follow the same pattern it did in the past. We might see different factors influencing Bitcoin’s value as the market matures.”

Conclusion: The Continuing Evolution of Bitcoin Halving

Bitcoin halving is a defining event in the life of the cryptocurrency. By reducing the number of new bitcoins created, halvings ensure that Bitcoin remains scarce, which could drive up its value in the long term. While the immediate effects of Bitcoin halving are felt by miners, the broader impact on the market and its price is far-reaching.

With each halving event, Bitcoin becomes more entrenched in the global financial system. The cryptocurrency’s role as a store of value, hedge against inflation, and digital asset is becoming more recognized by institutional investors and individuals alike. However, Bitcoin’s journey is far from predictable, and each halving brings its own set of challenges and opportunities.

As Bitcoin approaches its final halving events in the coming decades, the market will continue to evolve. But one thing is certain: Bitcoin halving will remain a crucial part of its journey, shaping its value and its place in the future of finance. Whether you’re an investor, miner, or crypto enthusiast, understanding the significance of Bitcoin halving is essential to navigating the ever-changing landscape of cryptocurrency.

In this blog, the topic of Bitcoin halving is explored from various perspectives, incorporating expert insights and community opinions to offer a comprehensive look at how this event shapes the world of cryptocurrency.